RFI Registration - Single RFI submitting CRS only

Scenario: I am a Single Financial Institution, and I will be registering and submitting CRS files only

The system allows CRS only registration.

Please register in the normal way Single RFI reporting to single RA

If the RFI wishes to register for CRS only the requirements are slightly different to FATCA only or CRS and FATCA Registration.

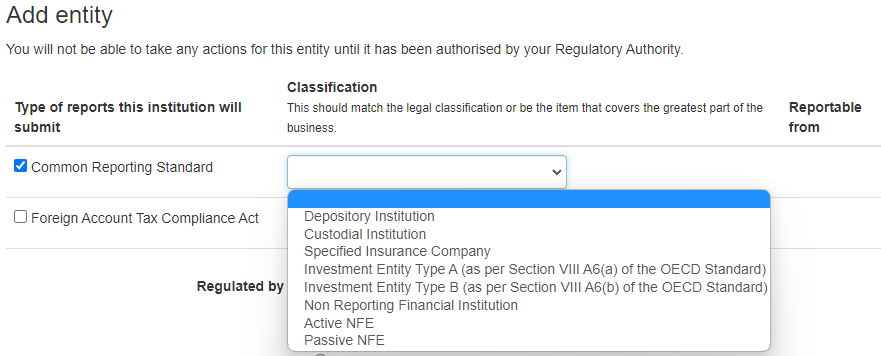

The user selects Common Reporting Standard

The classification must be selected and if the RFI has a reporting obligation, the Date became RFI needs to be completed. This determines the first reporting date.

The GIIN is optional.

Note: Please ensure that the “Name” of the entity is the correct full legal name including any appropriate symbols or punctuation (for example brackets). Shortened terms such as “Int.” or “Ltd.” should not be used unless they form part of the full legal name.

Where the name is auto-populated from the registered GIIN and this differs from the full legal name of the entity, this can and should be amended in the “Name” field.