RFI Registration - Single RFI reporting to single RA

Scenario: I am a Single Financial Institution reporting to a single Regulatory Authority. How do I register?

You have logged into the system. You will have been allocated one of the following roles:

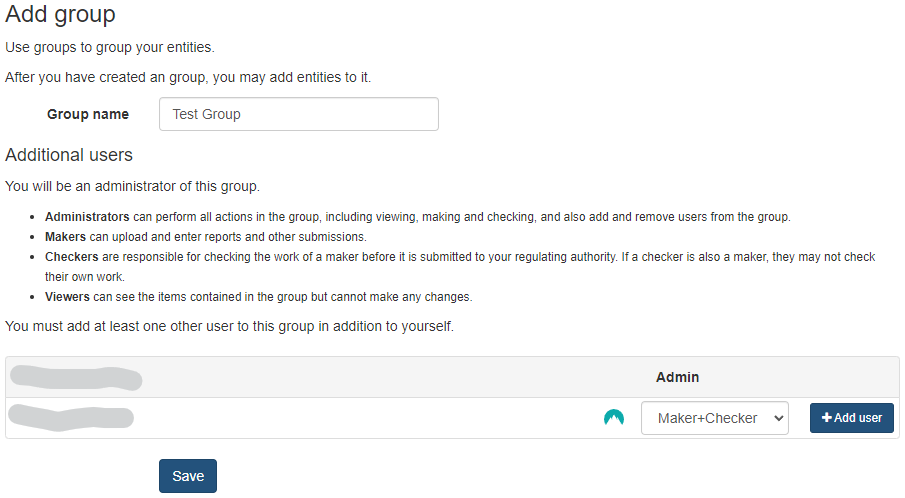

Administrators can perform all actions in the group, including viewing, making and checking, and also add and remove users from the group.

Makers can upload and enter reports and other submissions.

Checkers are responsible for checking the work of a maker before it is submitted to your regulating authority. If a checker is also a maker, they may not check their own work.

Viewers can see the items contained in the group but cannot make any changes.

Create a Group

The purpose of a group is to save you time in setting up one or more financial institutions with the same administrator, maker and checker. You give the group a name and add users to the group. The person creating the group will be the administrator.

Press Save

The Group name will appear in the left column.

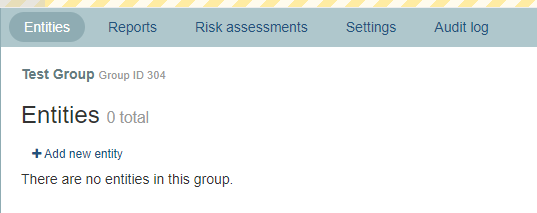

Add Entity

Add a new Entity / Financial Institution by clicking on the +Add new entity

This will bring up the Add entity screen.

Note: You will not be able to take any actions for this entity until it has been authorised by your Regulatory Authority.

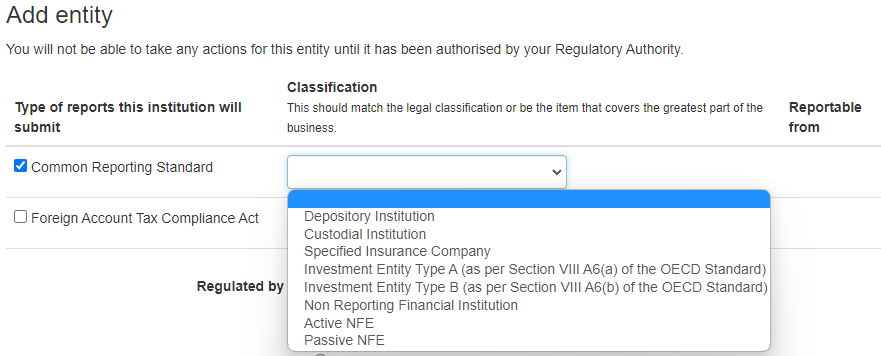

Clicking on the CRS box will provide a Classification dropdown which must be completed.

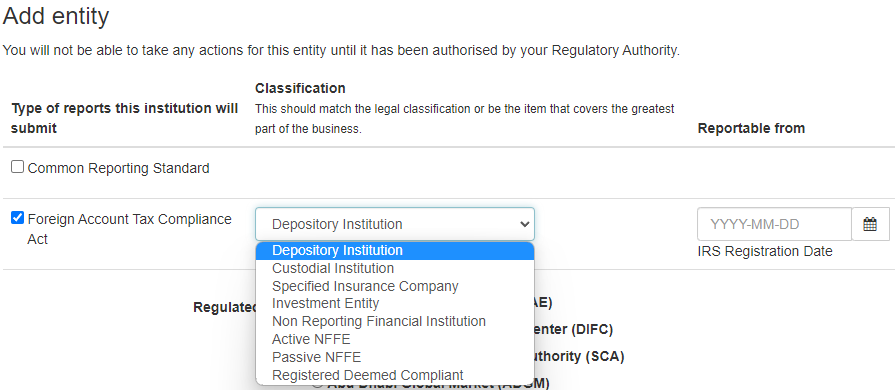

A similar dropdown is provided for FATCA Classifications.

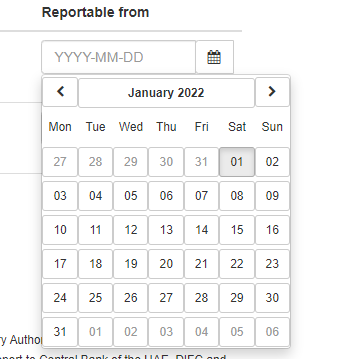

The Reportable from date can be entered manually or using the calendar tool.

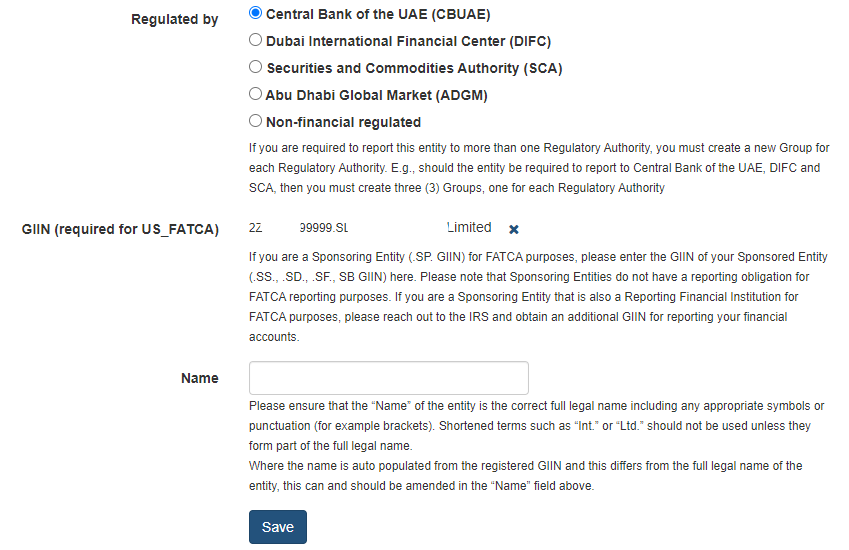

Select who you are Regulated by. Please note you can only select one Regulator. If you have more than one Regulator, please choose one of your regulators, and after completing the setup, refer to the Guides for information on "more than one Regulator".

If you are Registering for CRS only, the GIIN is optional.

If your registration includes FATCA, then the GIIN is mandatory.

GIIN

The full list of GIINs in the system is kept up to date. However, please note the IRS currently update their GIIN list once a month. So it may be a few weeks before a newly issued GIIN appears.

Type in part of the name or the GIIN number, and the system will search for UAE GIINs which match. Select the correct GIIN.

Note: If you are a Sponsoring Entity (.SP. GIIN) for FATCA purposes, please refer to the Guide related to Sponsors.

Once completed, press Save

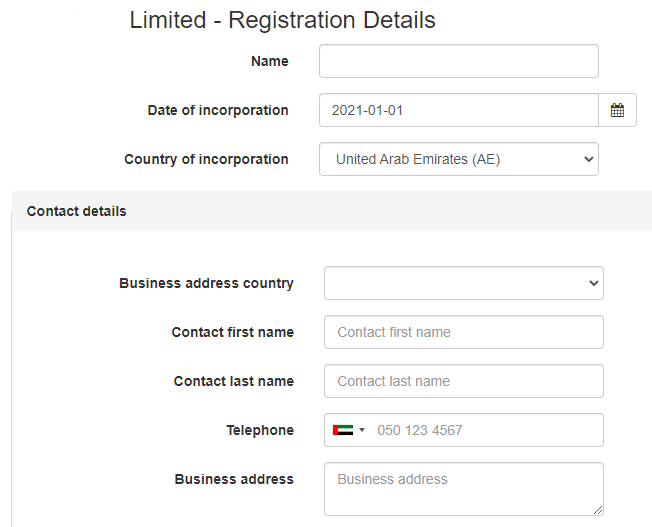

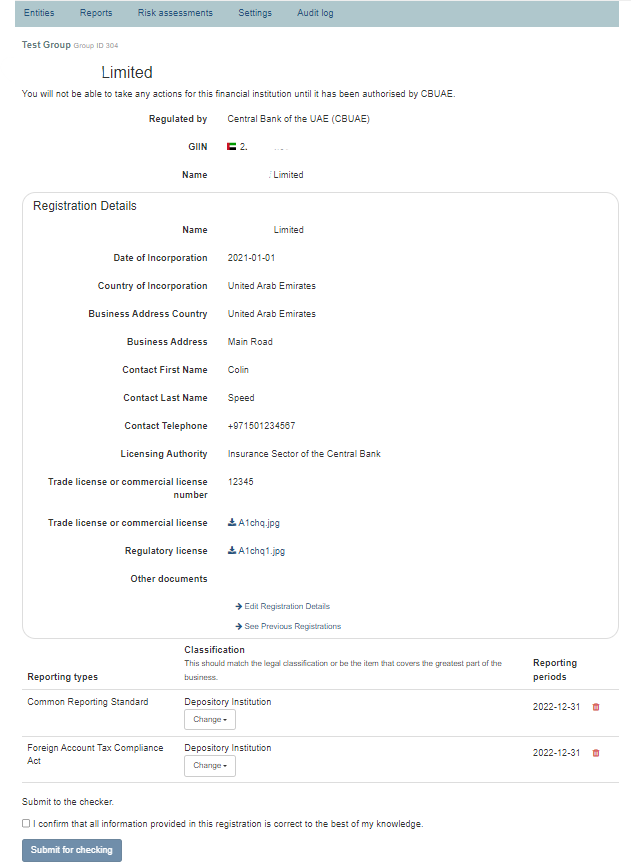

Registration Details

Complete the form, including

Date of Incorporation

Business address country

Contact first name

Contact last name

Telephone number (which is validated)

Business address

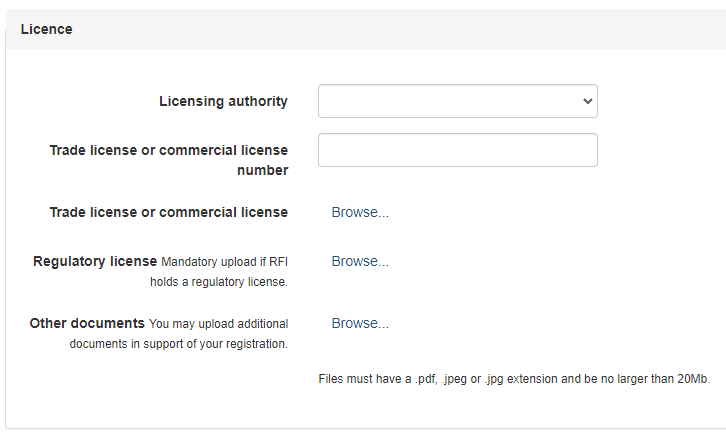

The bottom part of the form requires Licence information.

The licencing authority is a drop-down list.

The Trade or Commercial licence and Regulatory licence can be uploaded in .pdf, .jpeg or .jpg format.

The registration can be saved, and items such as the uploaded licences can be added later. However, the Registration cannot be Submitted for Checking until all the information has been provided.

Summary

A summary of the information entered will be shown and can now be Submitted for Checking.

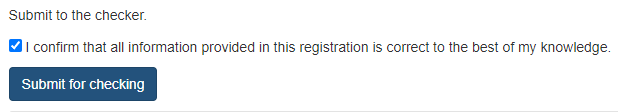

To Submit for Checking, click on the box to confirm the information provided is correct and press the Submit for Checking button.

The Checkers within the group will receive an email informing them there is a new RFI Registration which is awaiting checking.

Note: if a Maker is also a Checker, they cannot check their own work.

Checking

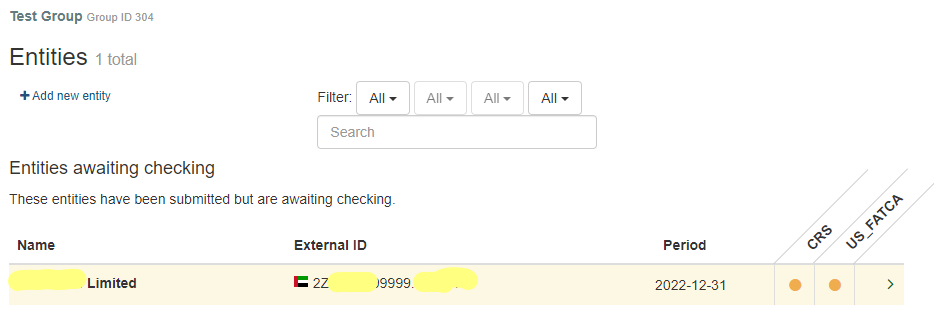

When the Registration has been submitted for checking, the Checker can sign into the system and perform this action.

Clicking on the Group name in the left column, they will see the following screen of Entities awaiting checking. The yellow colour means it has not yet been authorised by the Regulatory Authority.

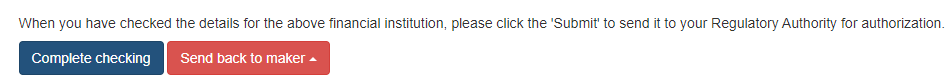

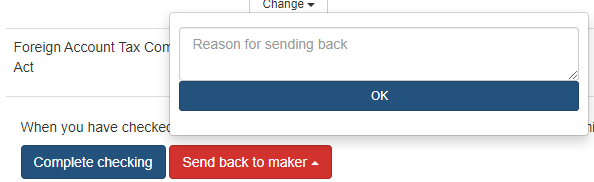

Clicking on the name of the Financial Institution screen will allow the user to see the Summary screen with the option to Complete Checking or Send Back to Maker.

If they wish to send back to Maker, then a Reason must be provided.

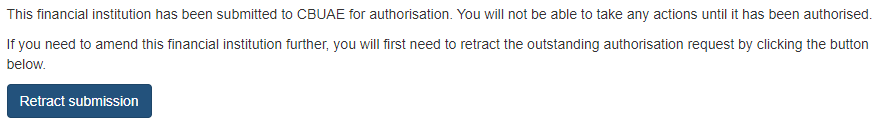

This important message will be displayed.

Completion of RFI Registration

This completes the RFI Registration process.

You will be informed once the Regulatory Authority has approved (or rejects) your Registration.

Note: Data File Submissions (Excel spreadsheets) cannot be submitted until the Financial Institution has been Authorised.