RFI Registration - Single RFI submitting FATCA only

Scenario: I am a Single Financial Institution, and I will be registering and submitting FATCA files only

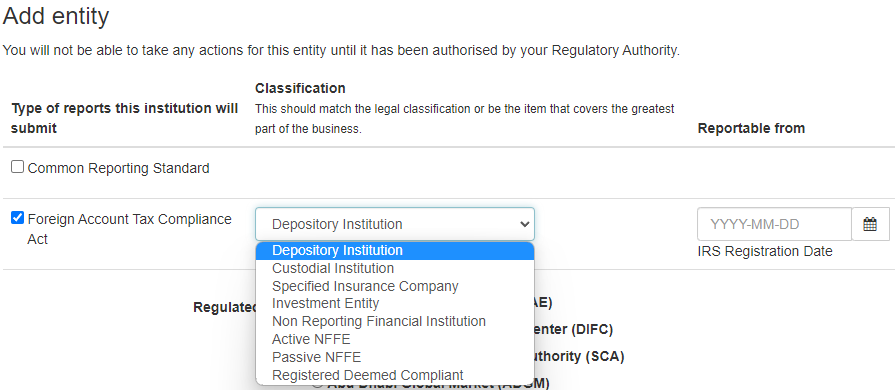

All entities that select a Reporting Financial Institution classification for the purposes of FATCA are required to provide a GIIN. i.e. Depository Institution, Custodial Institution, Specified Insurance Company, Investment Entity or Registered Deemed Compliant FFI.

Please note that Registered Deemed Compliant FFIs are required to provide their GIINs, but a reporting obligation is not triggered if that classification is selected (i.e. Registered Deemed Compliant FFIs are not required to report annual or nil returns).

The system allows FATCA only registration, CRS only registration and both CRS and FATCA registration.

Please register in the normal way Single RFI reporting to single RA

If the RFI wishes to register for FATCA only, or for FACTA and CRS, the information required is the same.

This includes the IRS Registration date and the FATCA Classification.

Global Intermediary Identification Number (GIIN)

The GIIN is also mandatory.

The GIIN list is "A monthly published list of Financial Institutions registered, accepted, and issued a Global Intermediary Identification Number (GIIN) in accordance with FATCA regulations."

As it is published monthly, please allow adequate time to Register and meet your reporting obligations.

The user can search for the GIIN using the GIIN or the name of the Entity.