Maker Checker

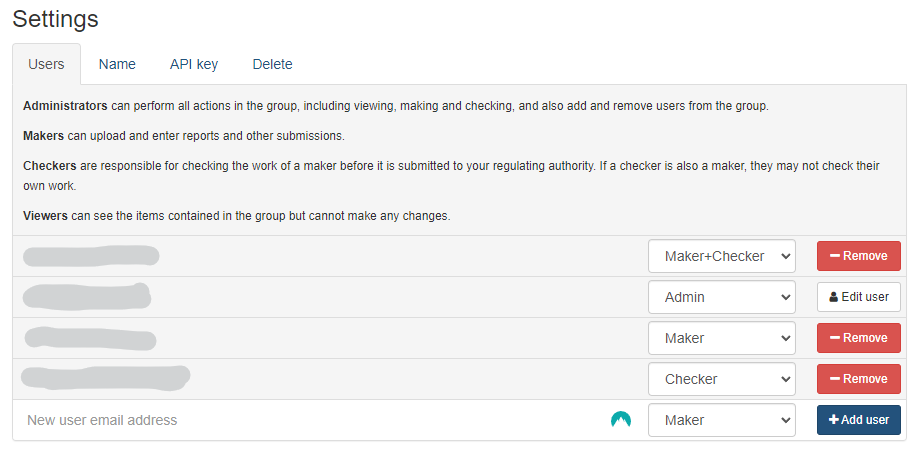

Makers and Checkers are set up in the Settings. Only the Admin can add users and change the settings.

All actions undertaken by users on the FATCA/CRS system are required to have a review process (i.e. a Maker user is able to perform an action, a Checker user is able to review the action and submit for authorization by the Regulatory Authority).

A person who is Maker and Checker may not check their own work.

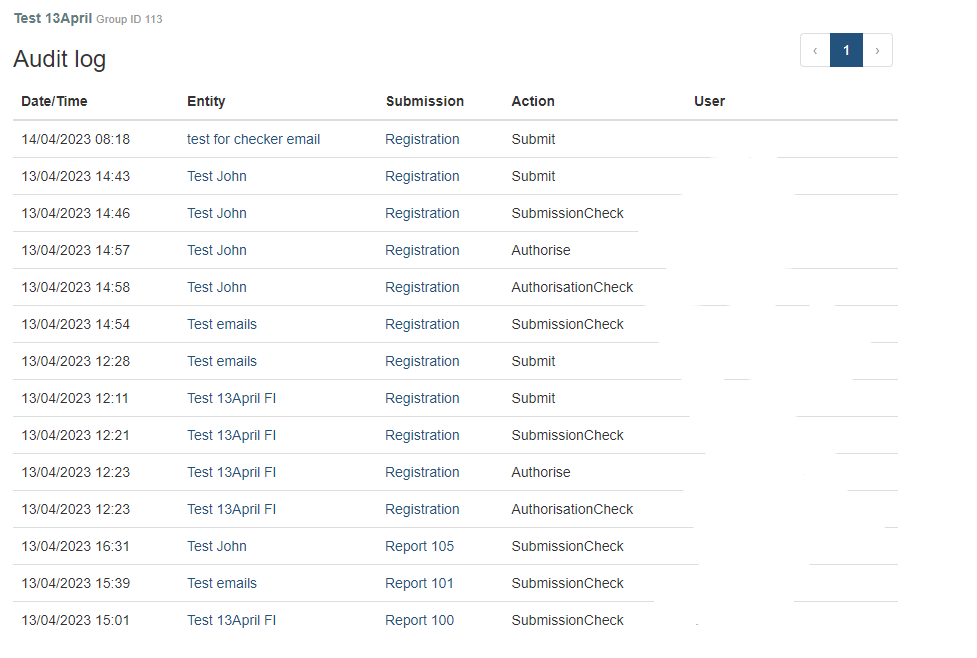

In order to provide transparency, the Audit log of Maker Checker actions are recorded under the Audit Log menu item with the user names displayed.

RFI Registrations

When you register an FI, you must be a Maker or Maker+Checker.

At the end of the form, when you Submit for Authorisation, an email will go to all Checkers

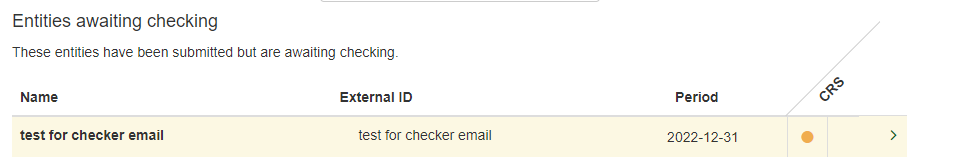

It will also show under the Entities menu item as follows:

When the Checker goes into the system, they can Complete checking or Reject the item.

If the RFI registration is rejected by the RA, you will receive an email informing you of this. The Maker user is then able to amend the registration and re-submit to the Checker user for approval.

Report Submissions (Annual Reporting / Nil Return)

When an Annual Report or Nil Return without errors has been submitted, the user will get a message saying "Report submitted successfully". There may be some warnings which will be passed on to the Regulatory Authority, but provided there are no errors, it can be submitted.

Going back to the Reports menu, select the report and review the contents are correct. At this point, it can be Accepted or Rejected. The same applies to Nil Returns.

For more information on Data Submission (Annual Reporting / Nil Returns), please refer to the user guide.