Data Submission (Annual / Nil Reporting)

Introduction

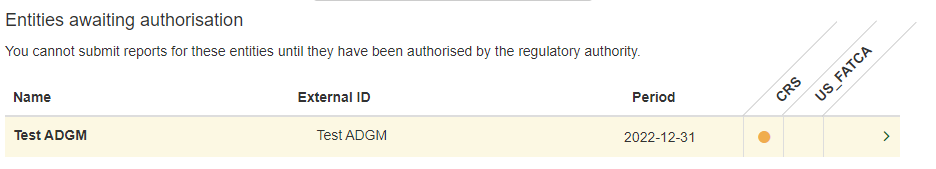

Submissions can only be made once the Financial Institution has been Authorised by the Regulatory Authority.

If the FI is listed in yellow and under the heading of Awaiting Checking, please advise the Checker within your organisation that the file needs checking so it can be sent to the Regulatory Authority for Authorisation.

If the FI is listed in yellow and under the heading of Awaiting Authorisation, you cannot submit a file. This is not an error, it is part of the process.

Once authorised, they appear in white under the Authorised entities section

Submitting a Report

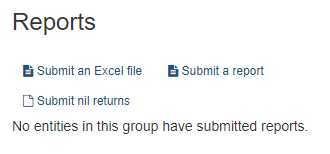

To submit a report, select the Group and the following menu will appear

Select Reports

You are provided with 3 options.

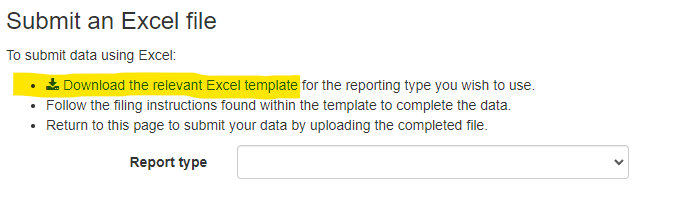

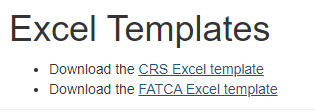

Excel Templates

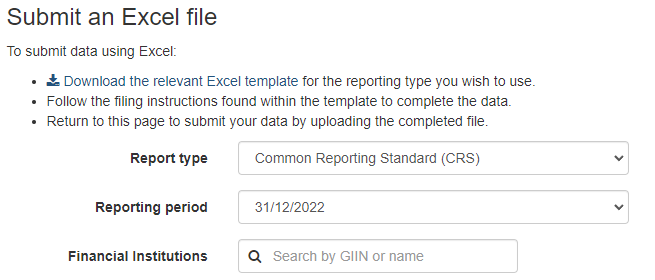

First, click on the Submit an Excel file and the following screen will be displayed. This contains a link to Download the latest Excel Template for your submission.

The Excel Templates are also available from the main Documentation menu.

The template will normally be downloaded into the downloads folder on your computer.

Only submissions using the Excel templates will be accepted. Please note there are some changes within the templates from previous years.

Please do not change the format of the Excel spreadsheet by adding columns, tabs or anything else that alters the structure of the spreadsheet.

Excel Submissions

Please complete the Excel spreadsheet for CRS and/or FATCA. The Excel spreadsheet has 2 main tabs

FATCA

Accounts

Substantial owners

CRS

Accounts

Controlling Persons

The other tabs in the spreadsheet contain further information which should help you complete the spreadsheets.

Once you have completed and saved the spreadsheet, select the Report Type

Browse to your file and upload (press open on some browsers).

The system may take a few seconds to process so please do not press any other buttons while processing.

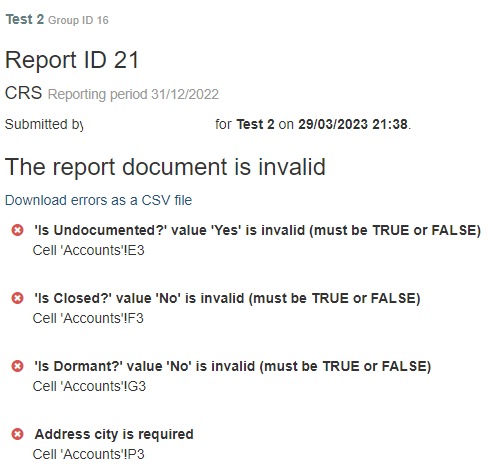

The system will provide you with a list of any errors and the spreadsheet tab name and cell reference, together with a description of the error.

There is also the option to Download the errors as a CSV file which can be opened in Excel.

The file will not be accepted or stored unless it is submitted with no errors.

If there are errors, the Excel spreadsheet needs to be corrected and submitted again until it is correct.

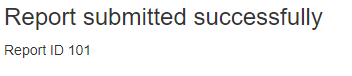

A successful file will show the following message

Maker / Checker: Submitted filed will need to go through the Maker / Checker process.

The file is now awaiting checking.

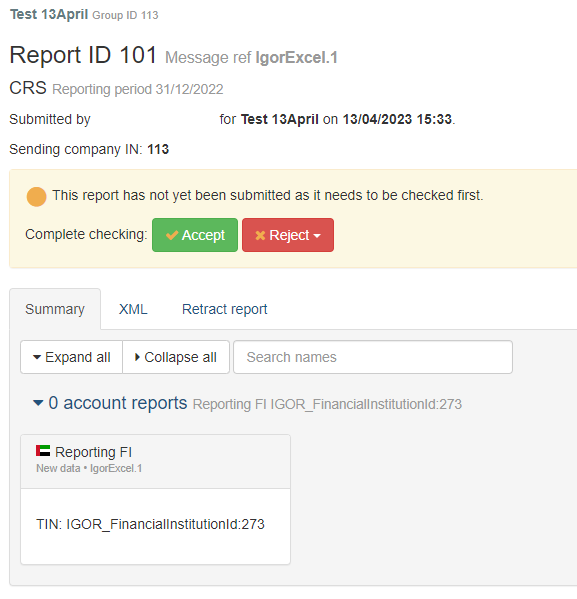

When the checker Signs into the system and clicks on the file, the file will display as follows:

The Checker can either Accept the file or Reject it.

If they reject it, they will need to provide a reason. Click on the Reject button again if you wish to unselect Reject.

Accept will submit the report to the RA.

Summary

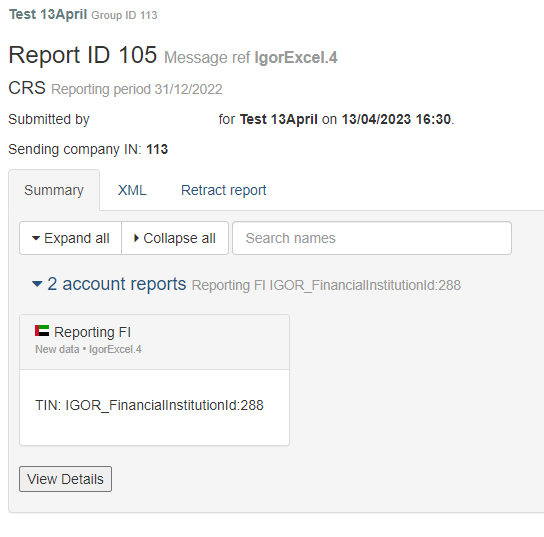

Clicking on a successful report will display a summary of the report.

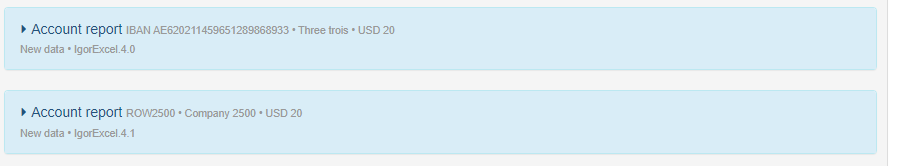

Clicking on View Details will allow you to drill down into further information.

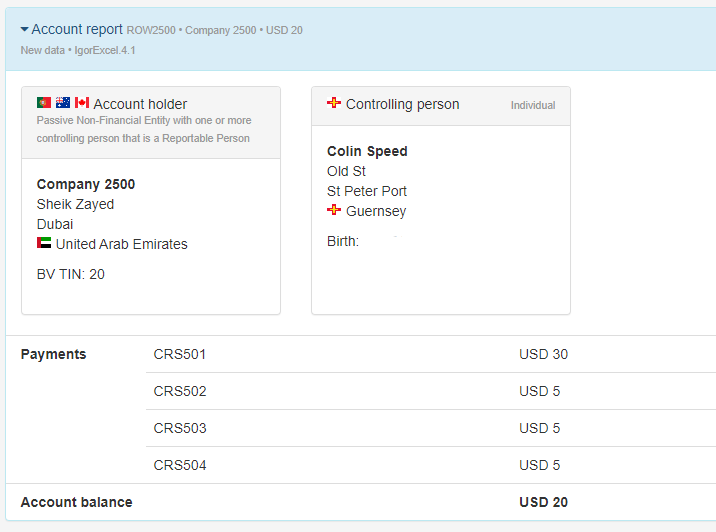

Clicking on the Account Report will show detail of that item.

Warnings

The system includes TIN Validation for the TIN numbers used by all jurisdictions. An incorrect TIN may generate a warning which will appear on the screen. This will not prohibit you from submitting the report, but the Regulatory Authority will also see the warnings and may require them to be corrected.

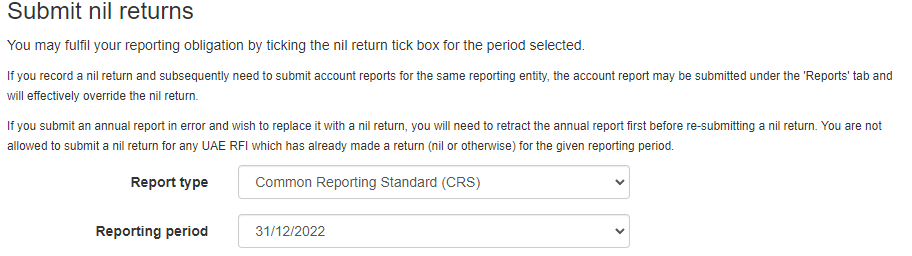

Nil Returns

If you are a Reporting Financial Institution that does not maintain financial accounts for the purposes of FATCA and/or CRS (for the reporting year CY2022), you are required to submit a nil return.

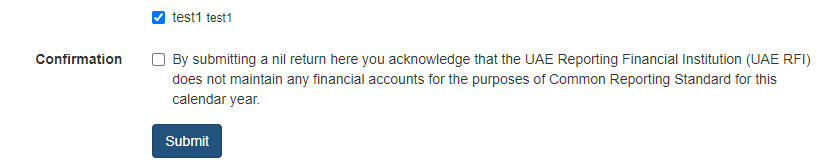

This is a simple process and the screen looks as follows:

Select the Financial Institution you wish to make the Nil Return for. If you wish to make a Nil Return for an FI where a report has already been successfully submitted, you need to Retract that report first.

You will be asked to agree to the Confirmation by clicking the check box.