Submission of data - FATCA

Scenario: I wish to submit my FATCA return, how do I do this?

First, you must have registered your Financial Institution and have it authorised by the Regulatory Authority.

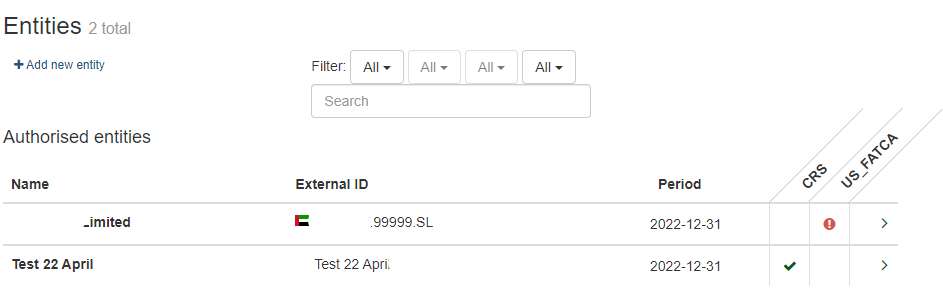

Once this is completed, the name of the RFI will appear with a white background in your list of entities.

The green tick shows a submission has already been successfully made.

A red circle with a white exclamation mark shows a submission is required for that reporting period.

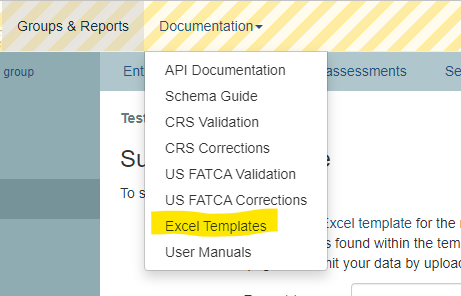

The Excel templates for FATCA and CRS may be downloaded by selecting the Documentation menu.

Once you have downloaded the template, please complete it in the normal way. The template should remain unchanged, and you must not add or remove any tabs or columns.

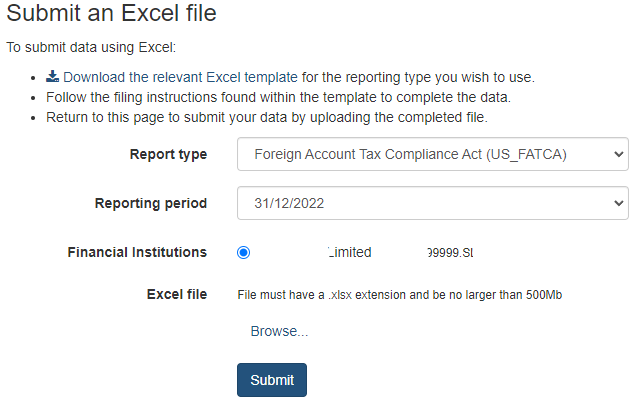

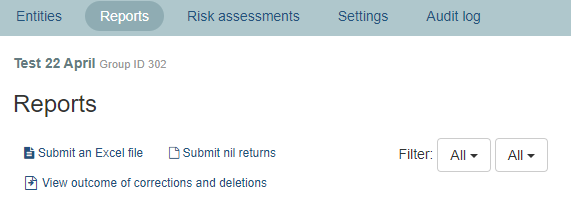

Click on Reports and select Submit an Excel File.

Select FATCA from the drop-down menu and the Reporting period. It will list all the Financial Institutions which have a reporting obligation for that reporting period.

If the Financial Institution you require is not listed, it may be for the following reasons:

The RFI has not been checked by the checker within your Group.

The RFI has not been authorised by your Regulatory Authority.

The reporting period for the FI is not currently open or set

The RFI has already returned an Excel spreadsheet.

The RFI has already submitted a nil return.