Submitting FATCA and CRS reports using XML

There are 3 ways you can enter data for CRS and FATCA

- You can use the API. This is a machine to machine based system which allows the electronic submission of the XML files.

- You can select Reports and manually Submit a report. This is only applicable where the XML file has already been created and you wish to upload it into ITIES.

- ITIES provides an easy to use set of forms for CRS and FATCA. This is designed for small volume, simple returns and have been provided to assist the smaller businesses.

You may submit reports using the ITIES website using a web browser, or directly from your own systems using the API. Both methods report detailed validation errors, should the report you submit be invalid.

A log of error messages from previously submitted invalid reports, as well as a log of the full content of successful submissions, is available on the ITIES website.

Submitting reports using the API

Under Settings you will find your API key. For report submission using the API, all financial institutions within an organisation share the same API key.

Screenshot

See the API documentation for information on integrating the ITIES API with your own systems.

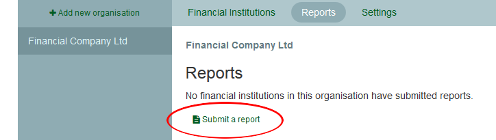

Submitting reports using the web portal

Under Reports, click on Submit a report.

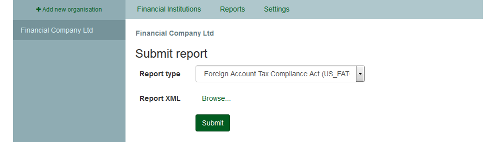

Select the type of report you are submitting and upload your XML file.

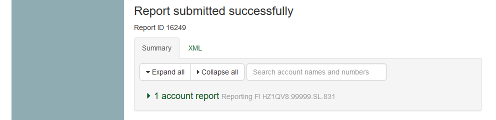

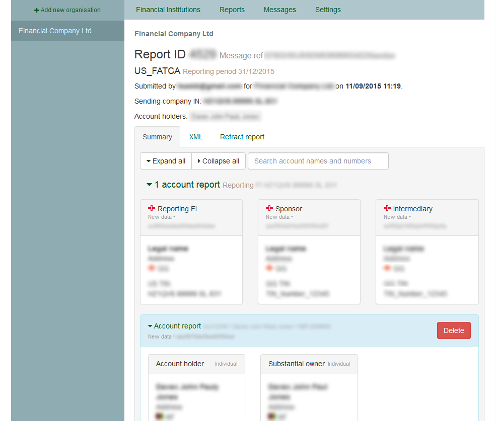

If your XML file is valid, confirmation of submission will be displayed, along with a report submission ID and a summary of the report contents.

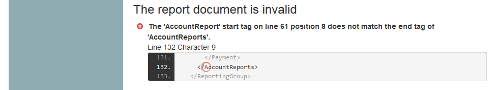

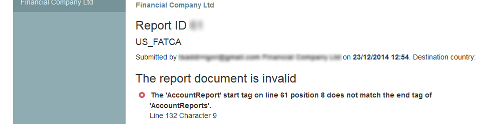

If your XML file is not valid, detailed error messages will be shown to enable to you resolve the problems and resubmit the report.

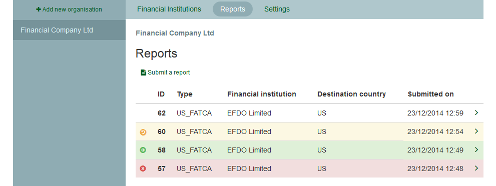

Viewing submitted reports

A log of error messages from previously submitted invalid reports, as well as a log of the full content of successful submissions, is available.

- Invalid reports are highlighted in red.

- Valid reports which have not yet been forwarded show on white.

- Valid reports which have been retracted (see below) are highlighted in yellow.

- Valid reports which have been forwarded to the destination country are highlighted in green.

Clicking on an invalid report will show the detailed error messages for the report.

Clicking on a valid report will show a summary of the report contents along with the submitted XML. You can also retract the report, or delete individual account reports (see below). You may search on account names and numbers to view a specific account report.

Clicking on a retracted report will show the date and time at which the report was retracted.

Clicking on a report which has been forwarded to the destination country will show the date and time at which it was forwarded.