Economic Substance Online Forms CBB

To create a report for a Financial Institution, select the Reports and Press the "Create a return by filling in an online form" which is highlighted in blue.

Select Economic Substance and select the Reportable Entities. All Entities will be listed for that Organisation that have Economic Substance returns to make. Press Create

Reportable Entity

The first page for submitting reports provides fields for the required details of the Reportable Entity:

Completion of Fields on this page:

Period start and end – you can use the calendar or type in the dates to match the financial Year End for the entity.

The Tax residence is defaulted to Bahrain but can be changed.

If the entity has a TIN please enter it in the TIN number field, if there is no TIN then “NOTIN” should be entered in the TIN number field.

For Tax Residence: you can select from the list or type some characters from the name. For example BAH will provide 2 options

You can also use the ISO Alpha 2 country code to return the correct location (Bahrain is BH).

Other Identification Numbers

If there is a different type of identification number, then these can be entered using the Identification Number fields.

Items with an * are mandatory according to the OECD specification.

When you have completed all the sections press Save at the bottom of the screen.

Confirmations

The next page of the ITIES system will take you through a set of questions. The questions asked will depend on the answers to previous questions.

Some questions will require a text explanation. Please complete as required.

The green bar on the left of the screen will show your progress in completing the form. It will be marked with a tick when you have successfully completed a section. You can go back to it and amend as required.

You will see Headquarters and Banking have been listed as Activities as these were ticked in the previous screens. If you need to change the Activities, please go back to the Confirmations screen and change the selection.

Once you have completed all of the questions, you will be able to move on to the Related Persons section.

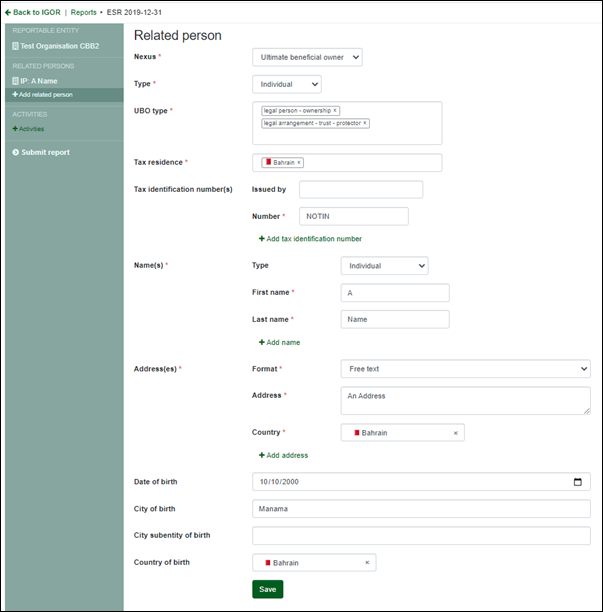

Related Persons

The Related Persons Pages are to be used to add all the related Persons.

The first requirement is to choose what the related person is, by selecting the Nexus Type. The types of related person are explained on this page.

Take great care selecting from the Nexus drop down as this will determine whether the report is forwarded to another jurisdiction:

For Immediate Parent and Ultimate Parent, the required Fields are the same:

Ultimate Beneficial Owner is expected to be an Individual.

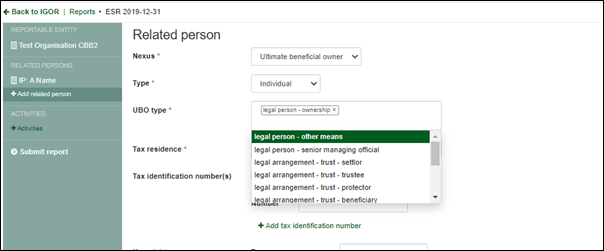

For UBO type you can select multiple options from the predefined dropdown.

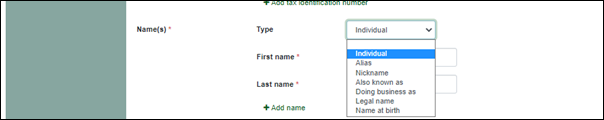

Select the name type from the dropdown:

a) Additional guidance for CBB licensees:

For Economic Substance (“ES”) reporting purposes, should the UBO be a sovereign entity of a GCC or FATF compliant jurisdiction, and where simplified customer due diligence applies given the associated ML/TF risks, a Licensee may not report the aforementioned UBO(s) in the annual ES forms on the ITIES portal. In situations where the aforementioned applies, Licensees shall provide a statement confirming the same.

Should the associated ML/TF risks lead to the application of customer due diligence or enhanced customer due diligence, a Licensee must apply the ownership and control test contemplated for legal entities in FATF Recommendation 10. In case no person(s) are identified as UBO(s) on the basis of such ownership and control test, the “Senior Managing Official” of the entity shall be reported as UBO.

b) Confirmation statements in relation to the UBO reporting for CBB licensees:

• Where a licensee is fully owned by a sovereign entity in a GCC or FATF compliant jurisdiction, a licensee shall provide the following confirmation statement:

“We confirm that our entity is owned by a sovereign entity in a GCC or FATF compliant jurisdiction, and is therefore subjected to simplified customer due diligence, given the associated ML/TF risks.”

• Where a licensee is partly owned by a sovereign entity in a GCC or FATF compliant jurisdiction, a licensee shall report the UBO details of the owners that are not sovereign entities under the “Related Party” section of the ES report on the ITIES portal as well as provide the following confirmation statement:

"In relation to the part owner of our entity which is a sovereign entity, we confirm that the sovereign entity is in a GCC or FATF compliant jurisdiction, and is therefore subjected to simplified customer due diligence, given the associated ML/TF risks.”

Once you have completed all the fields press “Save” and then if required, you can add further Related Persons.

Once you have completed all Related Persons, please complete the Activities section.

Activities

The Activities shown are taken from the items you ticked at the start of the form. If they are incorrect, please go back to the Confirmations question and re select.

Please note for Direct Expenses, "Direct expenses shall exclude Outsourcing Expenses and Salary Expenses. Outsourcing Expenses and Salary Expenses shall be reported separately in the below respective fields."

When finished adding all data click “Save” and select the next Activity until they are all completed.

Submitting Reports

Having Completed the Report, you can Submit it to ITIES or download the XML output you would normally Submit.

Depending on your previous answers, you may be asked to confirm the following "We confirm that our entity does not have an Ultimate Beneficial Owner (UBO) that holds equal to or more than 10% ownership, whether directly or indirectly or through a combination of direct and indirect ownership."

Note: Reporting Entities set up under Test Organisations do not require approval as they are only for testing.

If you have completed a report under a Test Organisation, please remember you will still need to submit a report using the Live (non test) Organisation.