Economic Substance Online Forms MOICT

To create a report for an entity, select the Reports and Press the "Create a return by filling in an online form" which is highlighted in blue.

Select Economic Substance and the Entity then press the Create button

Reportable Entity

The first page for submitting reports provides fields for the required details of the Reportable Entity:

Completion of Fields on this page:

Period start and end – you can use the calendar or type in the dates to match the accounting year or period for the entity.

The Tax residence is defaulted to Bahrain but can be changed.

If the entity has a TIN please enter it in the TIN number field, if there is no TIN then “NOTIN” should be entered in the TIN number field.

For Tax Residence: you can select from the list or type some characters from the name. For example BAH will provide 2 options

You can also use the ISO Alpha 2 country code to return the correct location (Bahrain is BH).

Items with an * are mandatory according to the OECD specification.

When you have completed all the sections press Next at the bottom of the screen.

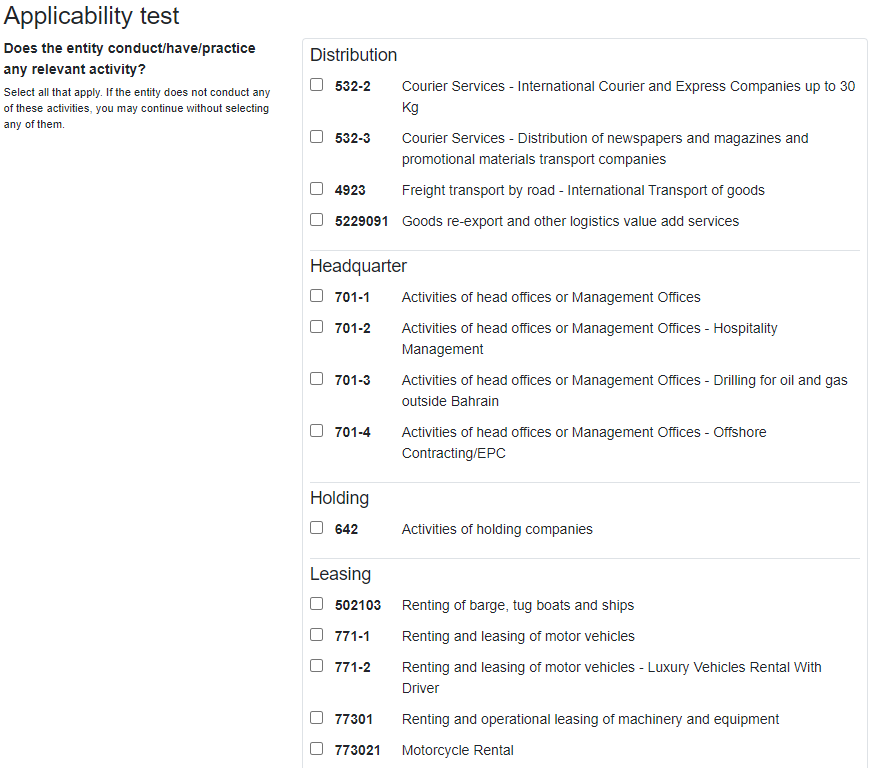

Applicability Test

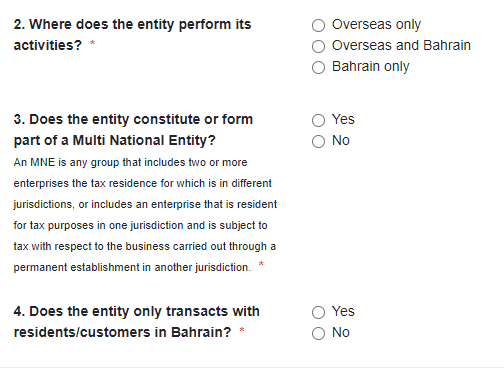

The next page of the ITIES system will take you through a set of questions. The questions asked will depend on the answers to previous questions. Please complete and save each page.

Some questions will require a text explanation and some will require you to upload some supporting documentation. You can leave the form by completing and saving the page and go back to it later as required.

The Applicability section asks for the activities you conduct and this is important for questions which are asked later in the form.

If any of the above are selected, you will then see the following screen at the bottom of the page

The green bar on the left of the screen will show your progress in completing the form. It will be marked with a tick when you have successfully completed a section. You can go back to it and amend as required. The illustration from below is from the MOICT questionnaire.

Once you have completed all of the sections, you will be able to move on to the Related Persons section.

Related Persons

The Related Persons Pages are to be used to add all the related Persons.

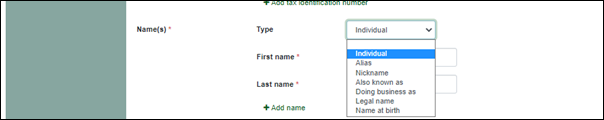

The first requirement is to choose what the related person is, by selecting the Nexus Type. A full explanation of the Related persons is provided:

Take great care selecting from the Nexus drop down as this will determine whether the report is forwarded to another jurisdiction:

For Immediate Parent and Ultimate Parent, the required Fields are the same:

Ultimate Beneficial Owner is expected to be an Individual.

If there is no TIN then “NOTIN” should be entered in the TIN number field

For UBO type you can select multiple options from the predefined dropdown.

Select the name type from the dropdown:

Once you have completed all the fields press “Next” and then if required, you can add further Related Persons.

Activities

The Activities shown are taken from the items you ticked at the start of the form. If they are incorrect, please go back to the Applicability test question.

If you select any of the activities in the Applicability test, you will need to complete the information for each of the MOICT sub categories.

When finished adding all data click “Next” and complete the next section.

These figures will be aggregated when they are sent to other jurisdictions.

Declaration

The declaration needs to be completed (note, the form which needs to be signed and uploaded is work in progress)

Submitting Reports

Having Completed the Report, you can Submit it to ITIES

Economic Substance reports made within a Test Organisation will require input into the live (non test) organisation in order to provide your return.

Checking the Status of a Report

The Entities screen will show the following

- A red circle with a white exclamation mark if neither the Economic Substance Return has not been submitted

- A green tick if you have submitted the Economic Substance Return for that period